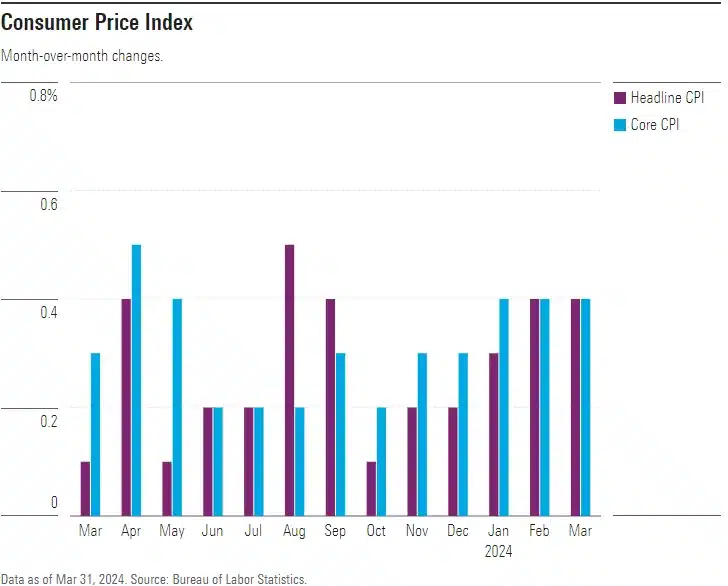

Inflation continued to run high for the third consecutive month in March 2024, raising questions about when the Federal Reserve will feel confident that price pressures are subdued enough to begin cutting interest rates.

According to the CPI Report March 2024 released by the Labor Department, overall prices increased by 3.5% from a year earlier, up from 3.2% in February. This surge was largely driven by the rising costs of rent and gasoline. Monthly, costs rose by 0.4%, similar to the previous month.

What is core inflation right now in 2024?

Core prices, which exclude volatile food and energy items and are closely monitored by the Fed, rose by 0.4%, consistent with the increase seen in February. This maintained the annual increase at 3.8%.

Table of Contents

CPI Report March 2024 Key Stats:

- The Consumer Price Index (CPI) increased by 0.4% for the month, mirroring the increase observed in February.

- Core CPI, which excludes volatile food and energy prices, also climbed by 0.4% after rising by the same amount in February.

- Year over year, CPI rose by 3.5%, up from the 3.2% growth seen in the prior month.

- Core CPI increased by 3.8% from year-ago levels, consistent with the rise observed in February.

Is inflation going down in 2024?

Since hitting a 40-year high of 9.1% in June 2022, inflation has significantly slowed down. However, following rapid improvement in the fall, price increases have accelerated monthly, ranging from 0.3% to 0.4% so far this year.

Read Similar: 2025 Toyota 4Runner vs. 2024 Toyota 4Runner: How Do They Compare?

Products such as used cars, furniture, and appliances have become less expensive as pandemic-induced supply bottlenecks have been resolved, although there was a notable increase in goods prices in February. However, the cost of services such as rent, car insurance, and transportation continues to rise. This is partly because pandemic-related pay increases have only gradually slowed down as worker shortages have eased.

Barclays anticipates that the monthly price gains will gradually ease, resulting in yearly inflation dropping to 3% and core price increases to 3.1% by the end of the year. However, this remains significantly above the Fed’s 2% goal.

Are the interest rates going down in 2024?

In recent weeks, Federal Reserve Chair Jerome Powell has indicated that the recent uptick in prices observed during the first two months of the year might have been merely a temporary blip. Powell emphasized that despite these fluctuations, inflation is still on track to approach the Fed’s 2% target, albeit navigating a potentially uneven path along the way.

However, the larger-than-expected rise in inflation witnessed in March has raised concerns that any anticipated market-friendly interest rate cuts could be postponed further. This concern is particularly pronounced given the recent robust performance of both the economy and the labor market.

The futures market is currently indicating that the Federal Reserve’s first rate cut will likely be postponed to September, with the Fed expected to lower rates just twice throughout the year. Previously, the market had anticipated the first rate cut to occur in June, with a total of three decreases in 2024, aligning with the median estimate provided by Fed officials last month.

In a note to clients on Wednesday, economist Paul Ashworth of Capital Economics remarked, “The third consecutive 0.4% monthly rise in core CPI pretty much eliminates any hopes of a rate cut in June.”

Kathy Bostjancic, Nationwide’s chief economist, commented that the report “will undermine Fed officials’ confidence that inflation is on a sustainable course back to 2% and likely delays rate cuts to September at the earliest and could push off rate reductions to next year.”

Since March 2022, the Federal Reserve has raised its benchmark short-term rate from near zero to a 22-year high of 5% to 5.25% to control inflation. However, officials have paused these hikes since July. Higher rates lead to increased borrowing costs for consumers and businesses, which typically results in a slowdown of economic activity.

Read More: What is Oatzempic? Is Tiktok Oatzempic Weight Loss Drink Helps?

What is the US stock market doing right now?

Stock prices weakened in response to the higher inflation rate. As of 10:45 a.m. EDT, the S&P 500 fell by 0.73%, and the Dow Jones Industrial Average slipped by 0.84%, reflecting investor concerns that anticipated interest-rate cuts may be delayed.

Prices for 10-year Treasury bonds, which are sensitive to inflation, declined, leading to an increase in their yields to 3.1%.

Inflation is emerging as a key issue in the presidential election. President Joe Biden remarked in a statement that while inflation has decreased by more than 60% from its peak, there is still more work to be done to lower costs.

“Prices are still too high for housing and groceries, even as prices for key household items like milk and eggs are lower than a year ago,” Biden said, highlighting the ongoing challenges faced by consumers despite some improvements in specific areas of the economy.

What is the reason for gas prices rising again?

Gasoline prices saw a 1.7% increase in March, marking the second consecutive rise following four consecutive monthly declines. This upward trend can be attributed to various factors, including the ongoing conflict between Russia and Ukraine, which has constrained the supply of Russian crude oil. Additionally, as the spring driving season approaches and demand for gasoline rises, prices tend to increase. Furthermore, producers often switch to more expensive summer blends during this time, contributing to the overall uptick in gasoline prices observed in March.

Will rent go down in 2024?

Together, the combined expenses of housing and gasoline accounted for more than half of the monthly increase in overall prices, reflecting the significant impact of these essential commodities on consumer budgets.

In March, the cost of renting accommodation saw a 0.4% uptick, marking a slight moderation from the preceding month but still contributing to a series of notable increases over recent periods. This adjustment resulted in a marginal decline in the annual rise to 5.7% from the previous 5.8%. While economists anticipate a moderation in rent increases based on new lease agreements, the transition has been gradual in terms of affecting existing lease arrangements.

Meanwhile, certain service-related costs continued their upward trajectory. Medical care expenses witnessed a 0.6% rise, while car repair costs surged by 1.7%, and auto insurance premiums increased significantly by 2.6%. Conversely, airfare prices dipped by 0.4% due to the decline in jet fuel prices.

On a positive note, some prices for goods experienced declines. Used car prices, in particular, fell by 1.1%, while the prices of new vehicles showed a marginal decrease of 0.2%. Additionally, appliance prices experienced a notable 0.7% drop. However, apparel prices bucked this trend by rising 0.7%, along with a 0.3% increase in furniture prices.

Are food prices going up or down in 2024?

Grocery prices remained unchanged for the second consecutive month, which slightly increased the annual increase to a still modest 1.2%. This stability in prices continued to offer consumers relief from the significant price spikes experienced during the peak of the pandemic.

Breakfast cereal prices saw a notable decline of 1.6%, while bread prices slid by 0.9% and cookies dropped by 1.2%, contributing to the overall stability in grocery prices.

However, prices for proteins generally saw an upward trend. The cost of uncooked ground beef increased by 0.7%, while bacon prices jumped by 0.9%. Eggs witnessed a significant surge of 4.6%, driven by another outbreak of bird flu, which impacted supply levels and subsequently led to higher prices.

Overall, while certain grocery items experienced price decreases, the upward trend in protein prices highlights ongoing challenges in the food supply chain, particularly in the face of external factors such as disease outbreaks.