Nvidia Corp., a leading force in the tech industry and the AI revolution, recently delivered its highly anticipated quarterly earnings report. While the company met or exceeded analysts’ expectations on several fronts, the report fell short of the lofty expectations set by investors. Concerns about production challenges with Nvidia’s next-generation Blackwell chips and an underwhelming revenue forecast led to a sharp decline in the company’s stock during after-hours trading.

Table of Contents

A Strong Quarter Overshadowed by High Expectations

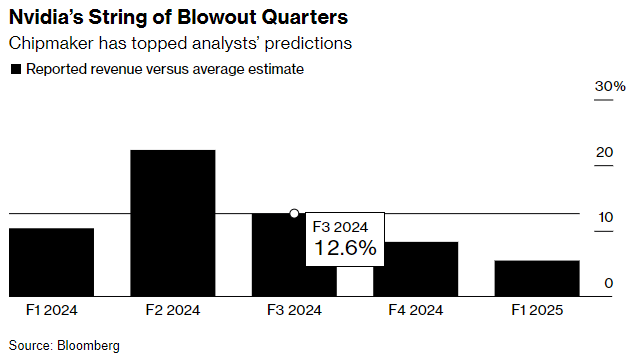

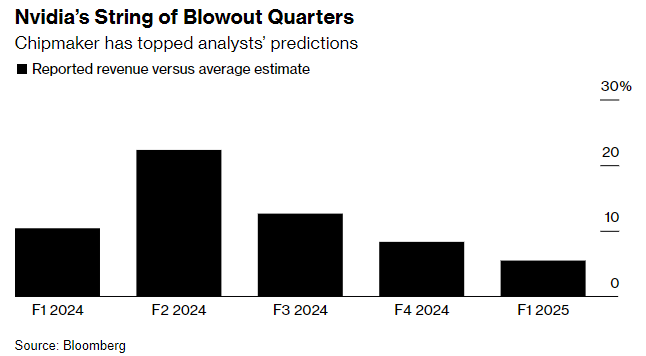

Nvidia’s latest earnings report, covering the fiscal second quarter of 2024, revealed that the company generated revenue of $30 billion, surpassing Wall Street’s expectations of $28.9 billion. The company’s earnings per share (EPS) also exceeded projections, coming in at 68 cents compared to the anticipated 64 cents. Despite these strong results, Nvidia’s stock, traded under the ticker NVDA, faced a significant drop of up to 8.4% in after-hours trading.

This decline underscores the high expectations placed on Nvidia, particularly given its remarkable performance earlier in the year, where the stock had more than doubled in value.

Power Outages in Detroit Metro Area Amid Extreme Heat and Storms

The company’s third-quarter revenue forecast was set at $32.5 billion, slightly above the average analyst estimate of $31.9 billion. However, this guidance fell short of some of the more optimistic estimates, which had ranged as high as $37.9 billion. The cautious outlook tempered the enthusiasm of investors, who had come to expect explosive growth and significant upside from Nvidia’s financial reports.

Blackwell Chips: The Next Big Thing Faces Production Hurdles

Central to the disappointment was the news surrounding Nvidia’s highly anticipated Blackwell chips. These chips are expected to be the next major advancement in Nvidia’s AI processing technology, which has been a cornerstone of the company’s growth and dominance in the semiconductor industry. However, Nvidia disclosed that the production of Blackwell chips has encountered unexpected difficulties. The company revealed that it had to make adjustments to its manufacturing processes to improve the yield—the proportion of functional chips produced from each batch—after encountering issues during production.

This revelation stoked fears of delays in the rollout of Blackwell, which is seen as Nvidia’s next big cash cow. The chips are poised to drive a fresh wave of growth for Nvidia, given the booming demand for AI infrastructure. However, concerns about potential production delays and their impact on Nvidia’s revenue stream contributed to the steep decline in NVDA stock after the earnings announcement.

During the Nvidia earnings call, CEO Jensen Huang addressed these concerns, assuring investors that the company is working diligently to resolve the production issues. Huang emphasized that Nvidia expects to bring in “several billion dollars” of revenue from Blackwell in the fourth quarter of the fiscal year, with production ramping up as the company overcomes the current manufacturing challenges.

Investor Sentiment and the AI Frenzy

Nvidia has been a key beneficiary of the AI boom, with its GPUs (graphics processing units) playing a vital role in training AI models and running complex algorithms. This surge in demand for AI technology has propelled Nvidia to become the world’s second-most-valuable company, with a market value exceeding $3 trillion. The company’s dominance in AI has been a major driver of its stock price, making NVDA one of the best-performing stocks in the S&P 500 Index this year.

However, the company’s reliance on a small group of customers for a significant portion of its revenue has raised concerns about its vulnerability to shifts in market demand. Approximately 40% of Nvidia’s revenue comes from large data center operators, such as Alphabet Inc.’s Google and Meta Platforms Inc., which have been investing heavily in AI infrastructure.

While these companies have increased their capital expenditure budgets, there is growing concern that the rapid pace of AI infrastructure expansion may outstrip current needs, potentially leading to an overbuild and a subsequent slowdown in spending.

Huang, however, remains bullish on the long-term prospects for AI and Nvidia’s role in shaping the future of technology. During the earnings call, he predicted that a trillion dollars worth of equipment would be needed to upgrade outdated data center infrastructure globally and that this replacement process was just beginning. Huang argued that AI is fundamentally transforming every layer of computing, from search engines to business processes to national security, and Nvidia is well-positioned to capitalize on these trends.

Future Outlook and Industry Competition

Despite the challenges with Blackwell, Nvidia’s existing product lineup continues to enjoy strong demand. The company’s data center division, which has become its largest source of revenue, generated $26.3 billion in sales last quarter, outperforming analyst expectations of $25.1 billion. Nvidia’s gaming chips, which were the company’s original claim to fame, also performed well, bringing in $2.9 billion, slightly above the projected $2.79 billion.

Looking ahead, Nvidia faces growing competition from other semiconductor companies, particularly Advanced Micro Devices Inc. (AMD) and Intel Corp. While Nvidia has maintained a dominant position in the AI chip market, these rivals are making strides to close the gap. AMD, in particular, has emerged as Nvidia’s closest competitor, though Nvidia’s revenue from AI chips still dwarfs the combined revenues of its competitors in this space.

The successful ramp-up of Blackwell production will be crucial for Nvidia’s continued dominance in the AI market. The company’s ability to meet the high demand for AI infrastructure while navigating production challenges will be closely watched by investors and industry analysts alike.

Conclusion: Navigating High Expectations and Production Challenges

Nvidia’s latest earnings report highlighted both the company’s impressive financial performance and the challenges it faces in maintaining its position at the forefront of the AI revolution. While Nvidia’s stock has been a standout performer, the production issues with the Blackwell chips and the tempered revenue forecast have introduced a note of caution for investors.

As Nvidia works to resolve these issues and meet the high expectations set by the market, the company’s future growth will depend on its ability to deliver on its promises and continue to lead in the rapidly evolving AI industry. The upcoming quarters will be critical for Nvidia, as it seeks to capitalize on the AI boom and overcome the production hurdles that have recently emerged.